(1) Appointing an Insolvency Practitioner (Liquidator) Creditors Voluntary Liquidation Processīelow is the process for conducting a Creditors’ Voluntary Liquidation. Obviously, this will vary depending on the complexity of the case. The only time directors would have to pay for the liquidation out of their own pockets is where the company assets fall below the basic cost of the liquidation, which is about £5000 + VAT. The important point to remember is that, assuming there are some company assets, any costs are taken from the liquidation itself. Some company directors, aware of the businesses situation, delay putting their company into creditors’ voluntary liquidation for fear of not being able to pay for it. What’s the Cost of Voluntary Liquidation? company debts are written off completely.The overall benefits of liquidation are that: That’s a considerably preferable scenario from receiving a winding up order via the court.ĭemonstrating you have taken a proactive role towards fulfilling your debt obligations is also beneficial, should there be investigations into directorial conduct. Choosing to liquidate means you can find your own insolvency practitioner and make the decision to liquidate within a timeframe that works for you. One of the primary advantages to choosing creditors’ voluntary liquidation, rather than waiting to be compulsorily wound up is the level of directorial control. What are the Benefits of Voluntary Liquidation ? Once the Insolvency Practitioner (IP) has taken over, your role as director will cease, though you will be requested to provide certain pieces of information to the IP as the process unfolds.

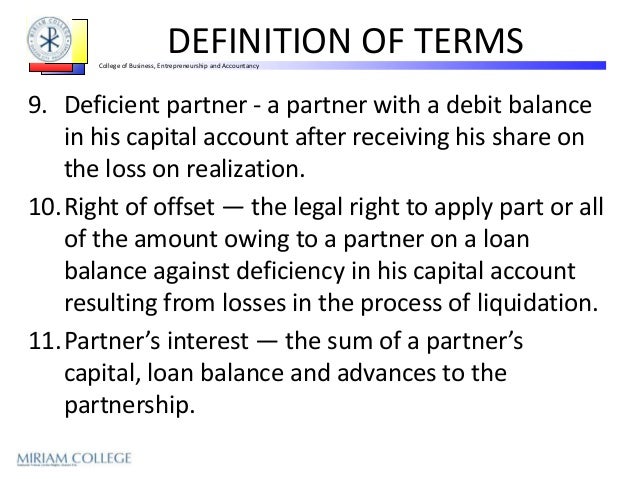

#Define liquidation professional

You’re either about to be forced into compulsory liquidation by creditors, or you’ve simply recognised the company is insolvent and has no future.Īt that point, choosing liquidation means you’re taking steps to close the company via the formal legal procedure, you’re going to bring in professional help, and you’re going to get creditor pressure off your back. Going into voluntary liquidation means you’ve reached a point where you feel the company cannot continue. Here’s we’re assuming that we’re talking about insolvent liquidation. What Does it Mean when a Company Goes into Voluntary Liquidation?

The IP will close down the company and sell any assets to seek the best return for company creditors, in order of priority. While protecting the company from further legal action, the choice to liquidate places the company in the hands of an insolvency practitioner (IP). Once directors have concluded that the logical decision is to close down the company, a 75% majority is required to instigate the process.

Insolvent voluntary liquidation is also known as creditors voluntary liquidation, and is when a company’s own shareholders vote to wind it up. Once the insolvent company has been liquidated the debts are wiped out along with the limited company itself. The Creditors’ Voluntary Liquidation process must be carried out by a licensed insolvency practitioner. It is routinely chosen by directors as a preferable alternative to being forced into a compulsory liquidation process via a winding up petition. A Creditors’ Voluntary Liquidation (CVL) is a process allowing the directors of a limited company, after a shareholders vote, to voluntarily close the company via liquidation.

0 kommentar(er)

0 kommentar(er)